- 1 Understanding Luxury Real Estate

- 2 Why Invest in Luxury Real Estate?

- 3 Evaluating Luxury Real Estate Investments

- 4 Strategies for Investing in Luxury Real Estate

- 5 Financing Your Luxury Real Estate Investment

- 6 Tax Implications of Luxury Real Estate Investments

- 7 Managing Your Luxury Real Estate Investment

- 8 The Bottom Line: Weighing the Pros and Cons

- 9 Frequently Asked Questions (FAQs)

Understanding Luxury Real Estate

Defining Luxury Real Estate: What Sets It Apart?

Luxury real estate is distinguished by its exclusivity, prime location, and high-end features. Unlike standard properties, luxury homes are defined by superior craftsmanship, unique amenities, and unparalleled architectural design. These high-end homes are often found in prestigious neighborhoods, coastal locations, or city centers like New York City and other metropolitan hubs.

Key Characteristics of High-End Properties

- Prime Location – Luxury properties are situated in sought-after locations such as Avenue districts, waterfronts, or gated communities.

- Exclusive Amenities – Features like private pools, home theaters, wine cellars, and smart home automation.

- Architectural Uniqueness – Custom-built homes with distinctive designs and high-quality materials.

- Security & Privacy – Gated properties, surveillance, and restricted access for maximum privacy.

Types of Luxury Real Estate Investments

- Residential Luxury Homes – Mansions, penthouses, waterfront villas, and high-end apartments.

- Commercial Luxury Properties – Office buildings, retail centers, and upscale hotels.

- Luxury Vacation Rentals – Exclusive homes rented to high-net-worth travelers.

- New Developments – Investing in pre-construction property in desirable locations.

Why Invest in Luxury Real Estate?

Potential for High Returns and Appreciation

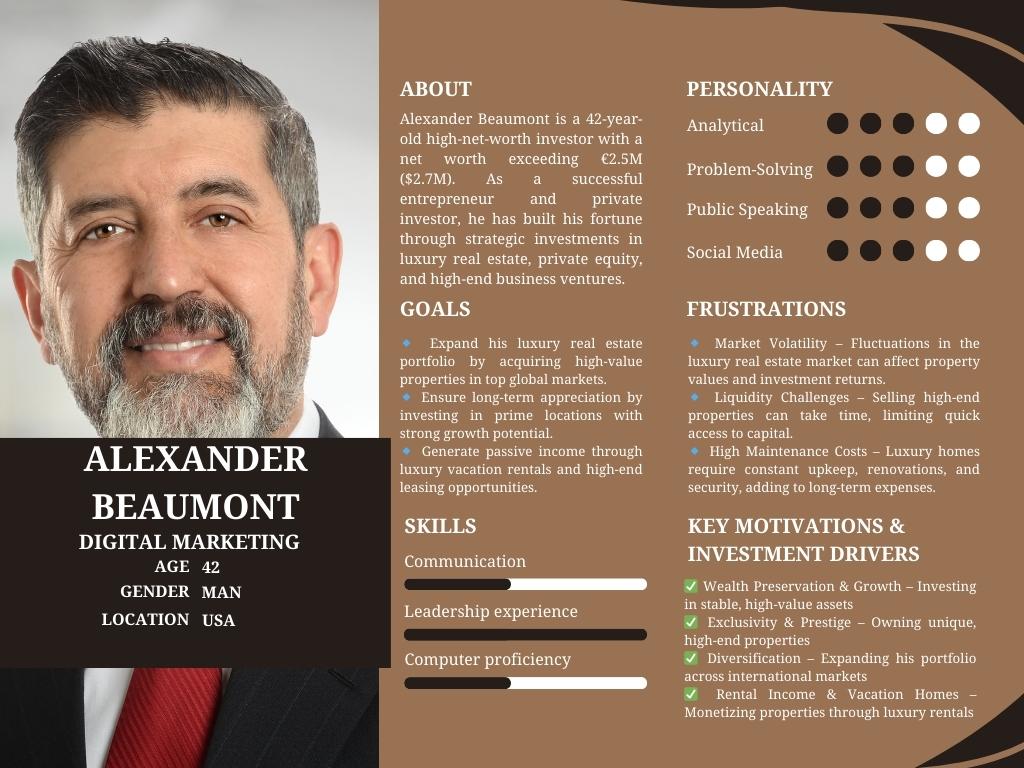

Investors are drawn to luxury real estate due to its high potential for returns. These properties often appreciate over time, making them an attractive investment for those looking to invest in luxury real estate.

Diversification of Investment Portfolio

Luxury properties offer a hedge against economic fluctuations. Unlike other investments, these high-end homes maintain value even during market downturns.

Lifestyle and Prestige Benefits

Owning luxury homes is not just about investment—it’s also about lifestyle. Investors gain access to elite communities, private clubs, and prime real estate in world-class cities like New York City.

Tax Advantages and Incentives

Depending on location, property ownership may come with tax benefits, such as deductions on mortgage fees, depreciation, and rental income taxation advantages.

Evaluating Luxury Real Estate Investments

Due Diligence: Researching Property Values and Market Trends

Before investing in luxury real estate, thorough research is essential. Understanding market fluctuations and recent real estate market trends ensures smarter investments.

Location Analysis: Assessing Neighborhoods and Potential for Growth

The location of a luxury property determines its long-term value. Investors should focus on growth potential, infrastructure, and demand.

Analyzing Property Features and Amenities

A high-end real estate investment requires assessing features that set the property apart—whether it’s a waterfront home, penthouse views, or state-of-the-art amenities.

Understanding Legal and Financial Aspects

Luxury estate transactions involve complex legal considerations, from zoning laws to tax implications. Consulting with professionals ensures compliance with property ownership regulations.

Strategies for Investing in Luxury Real Estate

Buying and Holding for Long-Term Appreciation

One of the safest approaches to investing in luxury real estate is purchasing properties in prime locations and holding them for time. As demand grows, so does value.

Flipping Luxury Properties for Short-Term Gains

Some investors buy undervalued luxury properties, renovate them with high-end features, and sell at a premium.

Developing Luxury Properties

Investing in new constructions or large-scale renovations can yield significant returns. Developing a luxury home with modern, exclusive features enhances value.

Investing in Luxury Vacation Rentals

Luxury rental homes provide income through short-term stays. Tourists and executives often seek high-quality vacation homes in exclusive locations.

International Luxury Real Estate Investments

Global markets offer investors the chance to invest in luxury real estate in booming locations like Dubai, London, and New York City.

Financing Your Luxury Real Estate Investment

Securing Financing: Jumbo Loans and Other Financing Options

Luxury homes often require jumbo loans due to their high price tags. Alternative financing methods include private lenders and real estate market partnerships.

Mortgage Rates and Their Influence on Investment Decisions

Interest rates affect affordability. Investors should monitor mortgage trends when planning to invest in luxury properties.

Working with High-Net-Worth Individuals and Family Offices

Luxury real estate market investors frequently collaborate with private wealth managers and family offices to fund large investments.

Tax Implications of Luxury Real Estate Investments

Capital Gains Taxes on Property Sales

Selling a luxury property may result in capital gains taxes, depending on the market and holding time.

Rental Income Taxation

For those generating income through luxury rental homes, understanding taxation on rental income is crucial.

Tax Deductions and Credits

Depreciation, property taxes, and maintenance costs often qualify for deductions, reducing the overall tax burden.

Managing Your Luxury Real Estate Investment

Property Management Strategies for Luxury Rentals

Hiring a management company ensures smooth operations, from tenant screening to maintenance.

Maintaining and Improving Property Value

Regular upgrades and smart renovations keep luxury properties competitive in the market.

Risk Management and Mitigation

Luxury real estate market fluctuations require strategic planning. Diversifying investments and ensuring insurance coverage helps protect assets.

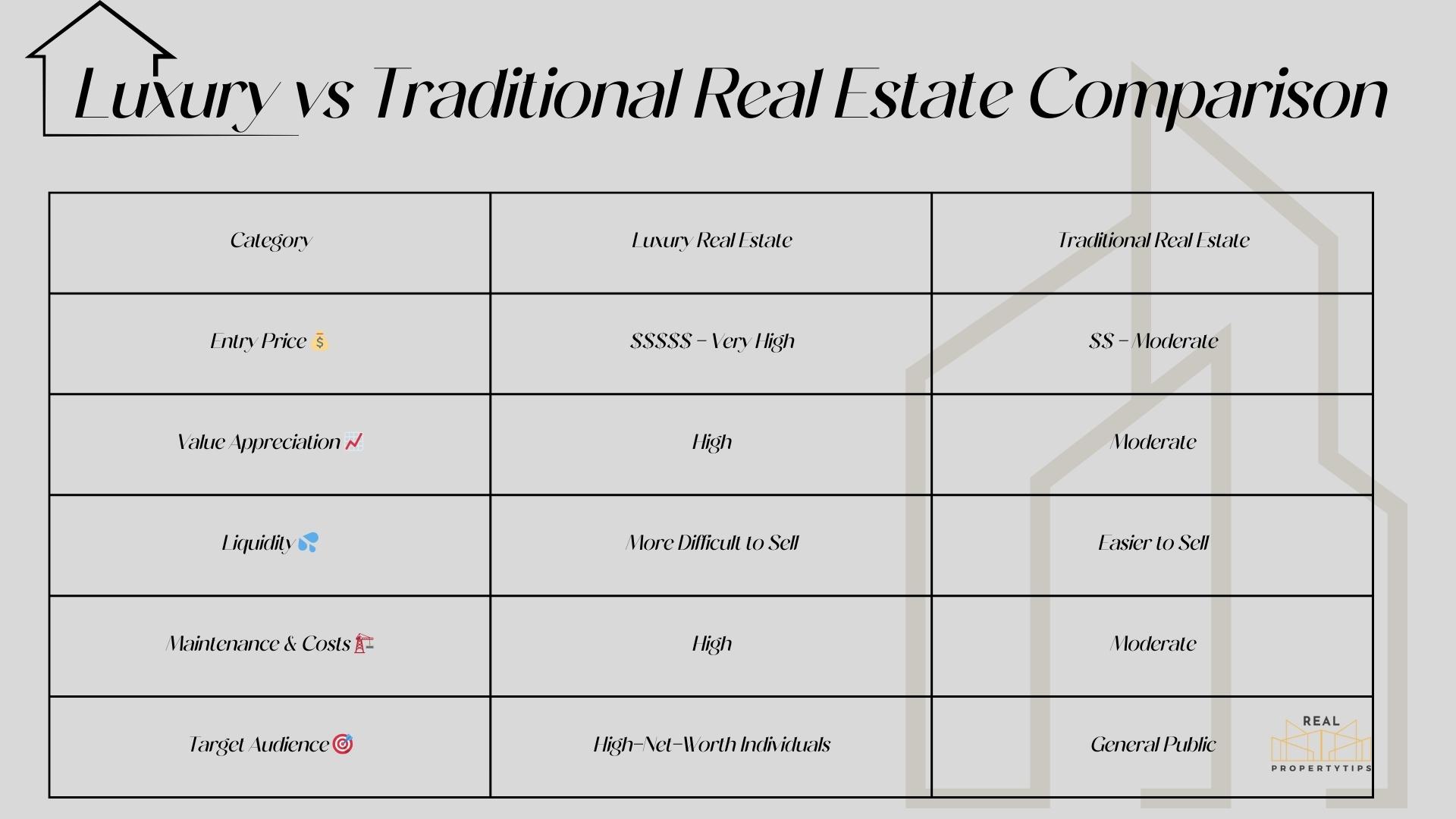

The Bottom Line: Weighing the Pros and Cons

Advantages of Investing in Luxury Real Estate

✔ High ROI and appreciation

✔ Prestige and lifestyle benefits

✔ Diversification of investments

Disadvantages to Consider

✖ High initial investment

✖ Market volatility and illiquidity

✖ Ongoing property maintenance costs

Frequently Asked Questions (FAQs)

What are the current luxury real estate market trends?

The luxury real estate market remains strong, with high demand in New York City and international hotspots.

How much does it cost to invest in luxury real estate?

Costs vary based on location, property size, and exclusive features.

What are the best locations for luxury real estate investments?

Top locations include New York City, Los Angeles, Dubai, and London.

What are the risks and rewards associated with luxury real estate?

Rewards include high returns and portfolio diversification, while risks involve market downturns and liquidity challenges.

How can I find a qualified real estate agent specializing in luxury properties?

Working with top-tier agencies and networking with high-end buyers helps connect with the right professionals.

Final Thoughts

Investing in luxury real estate offers both financial rewards and lifestyle benefits. With strategic planning, thorough research, and an understanding of market trends, investors can maximize returns while enjoying the prestige of luxury property ownership.